Josep Ruano

On life, the universe and everything. Food included.

The Day After Digital Transformation

There are many voices today talking about the digital transformation of the world and thus of businesses. Why is it so relevant? Moreover, once you have walked the journey of digital transformation of your business, what will come afterwards?

In this whitepaper, I aim to provide a glimpse at what might be foreseeable in the mid to long-term future for any company after digital transformation, using an evolutionary framework for exponential technologies as a model. I would like to help you think about the potential impact of digital transformation of your business and what may come next, helping you to improve your overall strategy.

In the last couple of years almost any technology vendor, and every IT analyst, have been talking about the Digital Transformation. That is not by chance. Every single industry will be transformed and disrupted by software in the near future - yours too, if not already. It is an inevitable change that no one will escape.

To give you some examples: photography, both personal and professional, clearly changed during the last decade; there is now a digital business built on our memories that just a few decades ago was limited to paper, physical goods or geographically near relatives. Cars are becoming more a software product than just an industrial one, forcing the car building industry to transform, too; Tesla updating their cars’ software every two weeks to change and improve the behaviour and capabilities of their vehicles –a release cycle more similar to that of a mobile app than to a traditional car. Books, music, and money are digital. Personal relationships have an important digital aspect nowadays (think of Facebook, WhatsApp or Snapchat), with a full economy operating around it, leveraging all this personal data. Even agriculture is being dramatically changed by digital technologies, enabling farming methodologies that are more productive, more science-based and that, hopefully, may even be friendlier with the environment.

In the industries that are ahead of the curve in this process, some incumbent players have been hit really hard, and many of them have died in the battle. But that is not new. A well-known and often-cited case of a big, well established and once profitable company that was killed by digital transformation in its early days, is Kodak; or, for sake of correctness, I should say that Kodak was killed by their own management failing to understand (or maybe to accept) the environment, their position in it (situational awareness) and the changes that were happening. I’ll talk more about Kodak throughout this whitepaper, as it is useful as an example in many cases.

The road of Digital Transformation

All businesses evolve from their genesis to commoditisation until they become, basically, a utility. We cannot guess how long it will take, but it is clear it is an evolution that will occur. During this process, the industry will move from an almost artisan approach, with highly customised services and/or products and high prices, to a fully industrialised model (a commodity), where the only differentiators are price and service level, sometimes with consumption-based pricing and supply elasticity (a utility). There are plenty of examples of this: power supply (a utility), personal computers (a commodity), furniture (a commodity), photography (a commodity) … it does not mean that different levels of maturity cannot co-exist; there will be always laggards, early adopters, and niche players. Rather it means that the largest portion of the demand will be supplied, eventually, by the most mature approach, leaving the less mature approaches for niche market segments (e.g. Luxury, tailor-made) and for a number of laggards that, if they are unable to adapt, will simply shrink until they die (and so do their providers).

Technology is the driving force pushing this commoditisation. Information technologies (i.e. software) are huge accelerators towards this; but converting a business into software goes far beyond commoditisation. It is not just about maturing a product or a service; it is about changing the playing field and the rules of the game. Think about Uber versus cabs, for example. Therefore, the so-called Digital Transformation is not the final stop. Actually, it is just the beginning of a long journey, just the first station on the way.

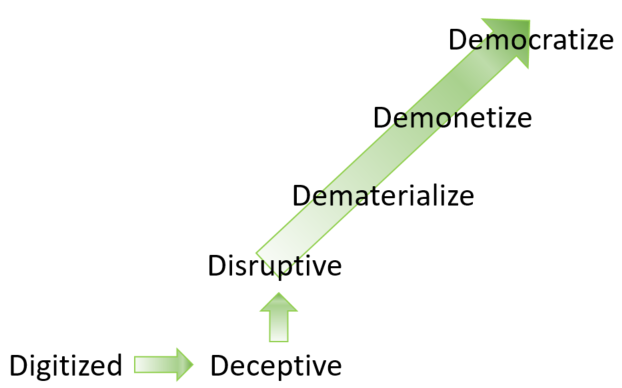

There is a framework to understand the evolution of exponential technologies called “the 6 D’s of Exponentials”, developed by Peter Diamandis and Steven Kotler 1, that presents the 6 stages every exponential technology traverse:

Figure 1. The 6D’s of exponentials by Peter Diamandis.

The first step of the journey is the digital transformation of the business, so your business becomes a “digitised business”.

The Business Digitalisation

What does the Digital Transformation of a business really mean? In its essence, it is converting any technology to an information-based technology, to ones and zeroes. Some simple examples include digital photography, moving from paper and chemicals to digital files in a computer memory; or about music and books, transforming tapes, LPs and paper into digital files, allowing for an immediate and near zero distribution cost per unit.

So, when managers and C-level executives talk about digital transformation, they are (or should be) talking about:

- Either, converting all their company’s processes and tools into digital processes and tools;

- Converting their products or services into digital products or services, if not at all –this is not always possible-, at least in the parts providing the most value to customers;

It is about converting the whole company into a digital company. For the companies choosing only the first option and skipping the second, we would be talking about efficiency improvements, or processes improvement, or in some cases linear innovation; in this case we are not talking about any transformation at all, because the core business will be essentially the same. However, if the company is choosing the second case (ideally the first and the second), then here we are talking about transformation; but you may ask: can all products or services be transformed into digital goods? The short answer is YES. Of course, it requires further explanation and clarification because, at the end of day, even though farming is being digitised, an apple remains an apple.

Digitising a product or a service does not mean converting it 100% into bits and bytes, because it is obvious that this is not always possible. If we want to take pictures, we need some sort of physical device to capture “the moment” in some form. If we want a car, obviously we will need some physical element – the car; Uber needs cars to operate (although they don’t own them) and, still, also drivers. But think about Tesla 2 3: of course Tesla cars are physical, but a big chunk of the value of a Tesla car is just software 4 5. The largest share of value delivered to the user is digital. That is precisely the point, the parts providing the most value to customers (core) are digital – and that is a huge change. To begin with, these core parts may not be the same once digitised that it was before. Continuing with the Tesla example, in a typical car, the value may reside in the engine, finish quality, brand, some electronics (that is more or less digital), and more intangible elements like security and safety (as a general feeling), the “pleasure of driving”… Of course, in Tesla there are non-digital elements that are key in their value proposition, like the huge driving range of their vehicles (for an Electric Vehicle) or the strategic location of their Superchargers to “refuel”. However, the majority of their perceived value comes from digital or digitised elements:

- the ability to buy it online. Tesla had digitised the distribution model: they have showrooms in some cities, in city centre, but few physical shops and owned by Tesla, not selling through dealer network; and that caused some troubles to Tesla as they are impacting another business too —independent car dealers network 6.

- the software embedded in the car providing abilities like autopilot, the huge screen, the apps you can install, or the fact that your car’s software is updated every 2 weeks to provide new features and capabilities.

Tesla really looks more like an app with wheels than a car, and that is thanks to the digitisation of the product.

This transformation has very deep implications. Once the company has been transformed into a “digital company”, it will be an (information) technology company solving certain needs with technology (mainly software), and no longer a company of a specific sector using tools specific of that sector —Of course, this is an exaggeration to emphasise the impact. As Edsger Dijkstra said, «Computer science is no more about computers than astronomy is about telescopes». The same applies here. Think about Airbnb: Airbnb may soon become one of the largest accommodation companies in the world by number of nights sold and by number of “rooms”, without having any hotel 7. It is one of the top players in the market without any of the associated costs of that market (although they have costs, of course, in fact at the time of writing they are operating at a loss). They shifted their principal cost structure from that of a typical accommodation company (real estate and properties expenditure, both CAPEX and OPEX), to those of a software company: development teams, user experience, cloud infrastructure, data analytics… So, what are they really? An accommodation company with strong IT, or an IT company hacking the accommodation sector?

Think of blockchain technology 8, probably one of the most disruptive technologies currently in the world: if we can decentralise (distribute) authentication and ledgers, in a tamper-proof way, and use it without any human intervention between transacting parties, what will happen to [current] banking in 10 years from now? And not only banking, but to any business or need based on a reliable registry, identity proof, or any other form of permanent registry of data 9.

Anything that can be digitised can be distributed globally at the speed of light for a marginal cost of near zero.

Welcome to Exponential Technologies

Once a technology is digitised, it becomes exponential; or, at least it has the potential to become exponential. But what is an exponential technology? Let us put a bit of context and historical perspective on that.

Exponential Technologies are those “technologies where each year the power and/or speed are doubling, and/or the cost is dropping in half” 10. A slightly more accurate definition may be technologies where the price/performance ratio follows an exponentially decreasing curve over regular periods of time.

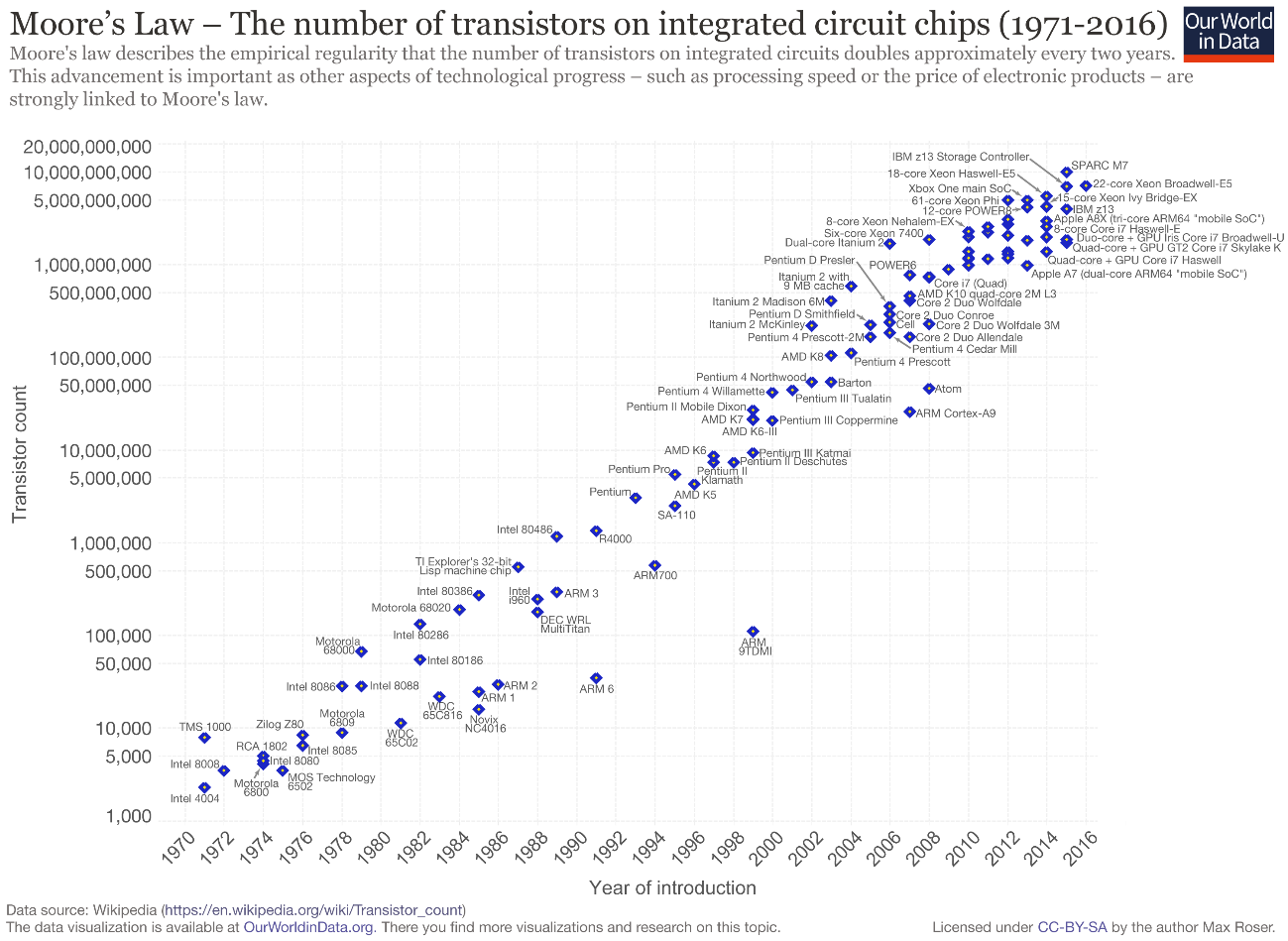

The most often quoted example is Moore’s Law 11, coined by Gordon Moore (co-founder of Fairchild Semiconductor and Intel) in 1965. Moore’s Law reflected the increase in power of microprocessors in terms of the number of transistors that can be integrated into a single chip 12. Moore’s Law postulated in 1965 that the number of transistors in a dense integrated circuit would double approximately every year. In 1975, looking forward to the next decade, he revised the forecast to doubling every two years. David House (an Intel executive) predicted that chip performance would double every 18 months, being a combination of the effect of more transistors and the transistors being faster. Moore had seven observations from 1959 until 1965 and he predicted a continuing growth for at least 10 years, but as explained by Max Roser, “he was not only right about the next ten years but astonishingly the regularity he found is true for more than half a century now” 13.

Figure 2. The evolution of Moore’s law 1970-2016. Note the logarithmic vertical axis chosen to show the linearity of the growth rate.

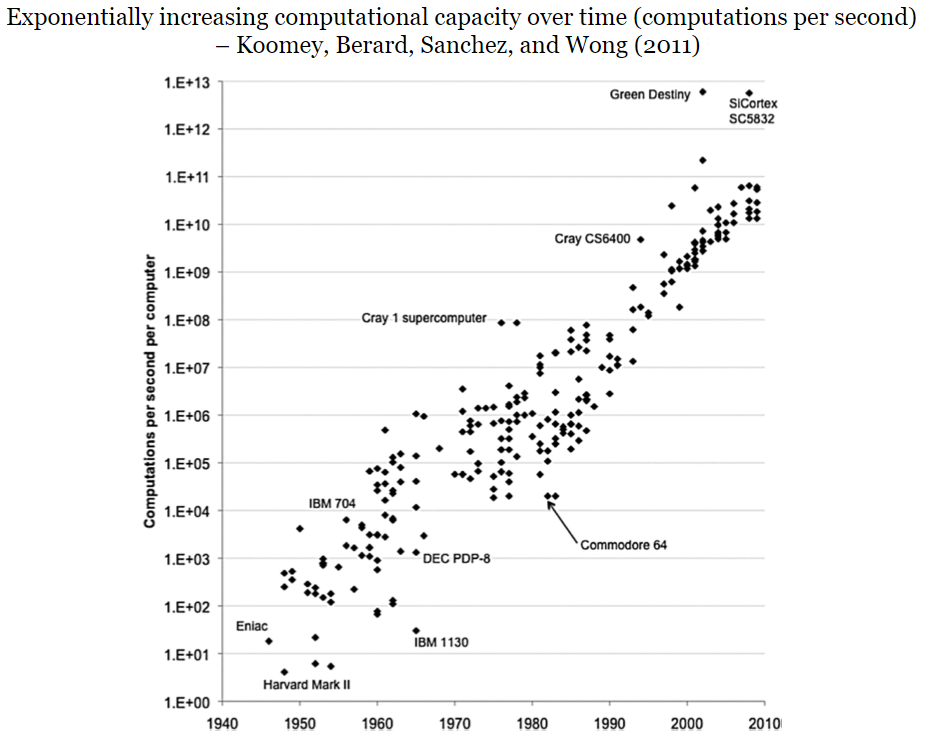

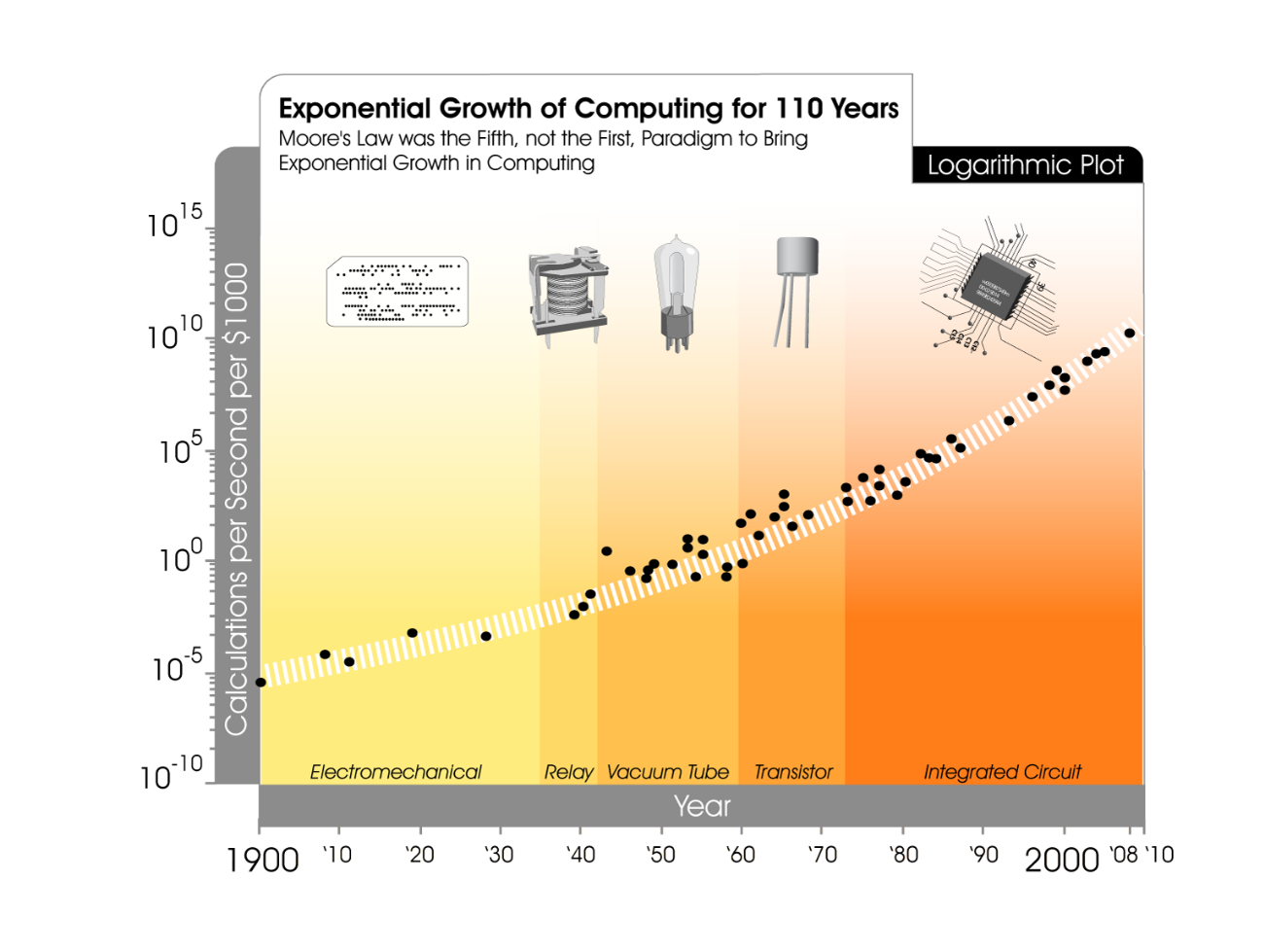

The reality is that we have been doubling computational power every two years throughout modern computing history, even before Moore’s law was forged, as we can see in the chart below 13.

Figure 3. Exponentially increasing computational capacity over time (computations per second) 1940-2010.

As an update to the graph above, at the time of writing, supercomputers built on top of Amazon Web Services (AWS) by combining multiple EC2 instances (multiple virtual machines) have been able to achieve 240 teraflops (trillions of computations per second), that is 2.4·1014 computations per second 14. One of the world’s most powerful computer today is Fujitsu’s K computer, which can perform at 10 petaflops, 40 times faster. However, with new cloud computing capabilities being added every day, we are not far away from overtaking Futjitsu K with public cloud computing.

Ray Kurzweil created a graph showing the computer power that could be purchased for a $1000 price tag from 1900 until 2010. It is especially insightful if one wants to understand how technological progress mattered as a driver of social change. Therefore, we have been exponentially increasing computational power for more than a century, not since Moore’s Law, but since the mechanical calculating devices used in the 1890 U.S. Census 15:

Figure 4. Exponential growth of computing for 110 years (1900-2010).

If you look the graph above, you will see that the vertical axis is a logarithmic scale; however, the plot is not a straight line (so an exponential growth), but another exponential curve. In Kurzweil’s words, “[…] there’s exponential growth in the rate of exponential growth. Computer speed (per unit cost) doubled every three years between 1910 and 1950, doubled every two years between 1950 and 1966, and is now doubling every year. […] It took ninety years to achieve the first MIPS (million instructions per second) per thousand dollars, now we add one MIPS per thousand dollars every day.” 15. So the pace is accelerating.

The supercomputer built on top of AWS runs an approximate cost of $1,279 per hour, so the next data point in the above graph by Ray Kurzweil is a 1024 calculations per second computer per roughly $1,000. A very significant increase.

One important caveat however is that while Kurzweil compares acquisition cost (CAPEX), in AWS we are talking about usage cost (OPEX) for 1 hour of use. The fastest supercomputer in the world at the time of writing, the Sunway TaihuLight 16, had an acquisition cost of US $273 million, for a 125,436 TFlop/s computer (peak performance, trillions computations per second). It is an approximate cost of US $2,176 per TFlop/s, while the AWS supercomputer had an approximate cost of US $5.33 per TFlop/s (having it only for 1 hour).

The important point here is that supercomputing has been democratised. Not many organizations can afford an investment of US $273 million, plus the huge operating costs of running a computer like the Sunway TaihuLight –its power consumption is approximately 15 MWh. However, most companies –even start-ups- can afford spending US $1,000 per hour, during some hours, to perform calculations; also, the fact that the cost has moved from CAPEX (investment) to OPEX (operating expenses), makes a difference regarding who can access this technology.

As I mentioned before, once a technology is digitised, it becomes exponential. At least it has the potential to become exponential. The good and the bad news is that most industries will be heavily digitised, if not fully digitised, by changing their business models after digitising core processes. Companies undergoing a real Digital Transformation –-that is digitising their products or services and not only their processes– will, in turn, substantially change their business models in most cases, disrupting the industry in which they operate or in some cases creating a brand new market segment.

Never before we have had so many technologies advancing so fast and converging at the same time as we do now. In a paper from INSEAD about Nokia, Olli-Pekka Kallasvuo, former CEO of Nokia, describes this convergence in the smartphone industry during his tenure from 2006-2010: “nowhere in business history has a competitive environment changed so much as it did with the converging of several industries – to the point that no-one knows what to call the industry anymore. Mobile telephony converged with the mobile computer, the internet industry, the media industry and the applications industry - to mention a few… and today they’re all rolled into one” 17.

That is probably because most of the technologies we developed until the end of the 20th century are now being digitised (either being converted into software or heavily relying on software), and most of the new technologies are designed with a “digital mindset” from the beginning. One of the key elements software has enabled is immediate, very low cost, knowledge sharing, enabling high speed improvement cycles by people working anywhere in the world – a global workforce collaborating, competing or co-opeting 18.

Historically, companies have been designed for scale and efficiency; with exponential technologies spreading widely, the world will run under a different heuristic: companies will need to be agile and adaptable. If the price/performance ratio of your services and/or products is exponentially decreasing, let us say every year or every half-year, or every 3 months… How do you plan your business? How do you design for efficiency and scale? How can you protect margins, have enough return on investments (supply chain, distribution chain, research, development and innovation), invest in sales & marketing, or be profitable? The challenge is gargantuan. It will –most certainly- require a new type of management for a new type of company.

All large organisations have been built to resist change, to be immune to change. That was in a time when the world was more linear than exponential, or at least the level of uncertainty was smaller. Therefore, it is highly probable that many organisations will collapse in the near future unless they review their base premises and are ready to get rid of them to adapt. According to a 2012 report from Innosight based on almost a century’s worth of market data 19, corporations in the S&P 500 index in 1958 stayed in the index for an average 61 years. By 1980, the average tenure in the S&P 500 had fallen to about 25 years, and in 2012 it was just 18 years. At current churn rate, 75% of today’s S&P 500 companies will be replaced by 2027!

The environment is constantly changing and is getting more unpredictable and uncertain every day. In this new landscape, speed is the new currency. The ability to adapt is the new key core skill. Being disruptive is the higher order challenge.

The great deception

So, you have digitised your business. But now… what’s next? You have two options, either:

- you just operate at a higher efficiency, thus having lower prices (being more competitive) or higher margins

Or

- You change your business model, maybe developing some new technology that enables you to have something unique, something scarce, at least for a while.

If you choose the first option, and only the first -–corresponding to the first case we have seen in “the Business Digitalisation”- you will probably be dead or at least suffering very soon. You are not alone in this race, so your competitors will have their business digitised eventually, if they do not have it before you. They will benefit from the same or even better efficiencies and advantages than you. In addition, other companies that were not former competitors to you at all, may become competitors or may just be cannibalising part of your business unintentionally. Think of mobile phones to photographic camera manufacturers. Or companies releasing for free internal tools that may replace existing commercial tools or services (for example open source tools like the ones from Netflix, Facebook, Microsoft, Adobe and many others).

It is also worth noting, about the first option, the importance of the way you adopt digital technologies. Although in this whitepaper we focus far beyond the adoption of digital technologies, it is important to remark that adopting digital tools requires changing business processes. Otherwise, you will end up with the worst of both worlds without any of the advantages. For example, adopting Twitter as a communication channel with your customers, but keeping in place an outdated communication process that requires many approvals before providing an answer to a customer, will drive Twitter benefits out as a channel for quick response, but will add the complexity of having to manage yet another communication channel. As obvious as it may seem that it is wrong, adopting new technologies with the same mind-set, framework and processes that we used in the past, is something seen very often. The most common example is trying to adopt public cloud computing (AWS, GCP or Azure), but continue to design and trying to implement in exactly the same way and with the same patterns that were used with traditional physical infrastructures on premises.

Therefore, you choose the second option (corresponding to the second case we have seen in “the Business Digitalisation”). New technology breakthroughs provide new scarcity to sell. New possibilities to meet new customer needs –-even needs they do not know they have. New chances to adapt to the new landscape that an always-changing world is providing. A landscape that some people think is driving us to a world of abundance (a world without scarcity) 20. In most businesses, we sell scarcity and/or information; asymmetry of information between parties can be seen as scarcity of information upon one party. If goods can be digitised, so they become information, and because information can be globally distributed for a very low cost at a very high speed, then we will not have either scarcity or asymmetry of information. If we do not have scarcity, in many cases you do not have a business.

However, new technologies come with immaturity. Technologies have to be used in the field, scaled, tested, and improved. Like a newborn child, a new technology is living in a world full of risks and dangers committed to make it fail or to kill it. Of course, you will need early adopters to grow your business, but it is unlikely you can make a living out of early adopters alone, because they are few and they will likely not represent enough amount of money to make the business profitable and sustainable.

So, what is the smart choice? The answer is both of them. You need to go on with the first option to drive income but, more importantly, to assure you can be nimble and adapt when the new technology is ready for the market (and the market is ready to buy it). Then, once you are agile and nimble, and able to put metrics on top of any process, you have to rethink your products, services and selling propositions. It is better to cannibalise yourself before others cannibalise you.

Equally, if you are not efficient operating your business due to legacy or other inefficiencies, a new competitor may appear, designing your same business from scratch, from a blank page, with no legacy or historical loans to pay at all, rapidly putting you out of business. So digitising your business is not an option a company can afford to avoid anymore unless you’re operating in a niche segment, a very small market segment, or you have a strong vendor lock-in (like IBM has with the Mainframe market).

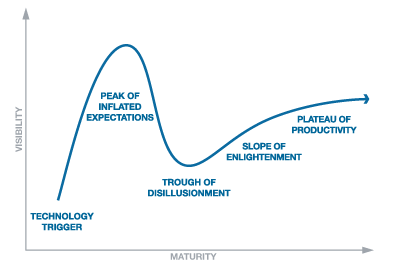

Gartner’s Hype Cycle 21 (below) clearly summarises the evolution of any technology. It makes no sense to write specific times down the horizontal axis, as we do not know when a specific change will occur, but we do know the different maturity stages any new technology will go through, regardless of how long it takes to move from one stage to the next.

Figure 5. Gartner hype cycle.

Quoting from Gartner, it all starts with a Technology Trigger: A potential technology breakthrough kicks things off. Early proof-of-concept stories and media interest trigger significant publicity. Often no usable products exist and commercial viability is unproven. This stirs the next phase up, the Peak of Inflated Expectations: early publicity produces a number of success stories –often accompanied by scores of failures. Some companies take action; many do not, pushing the technology to the Trough of Disillusionment: interest wanes as experiments and implementations fail to deliver. Producers of the technology shake out or fail. Investments continue only if the surviving providers improve their products to the satisfaction of early adopters. Technology continues to mature to the next phase, the Slope of Enlightenment: more instances of how the technology can benefit the enterprise start to crystallise and become more widely understood. Second- and third-generation products appear from technology providers. More enterprises fund pilots; conservative companies remain cautious, waiting for greater technology maturity and adoption. Finally, the technology may reach the Plateau of Productivity: mainstream adoption starts to take off. Criteria for assessing provider viability are more clearly defined. The technology’s broad market applicability and relevance are clearly paying off.

As we can see, all technologies mature over time. Any new technology will become more efficient (in the sense of price/performance) over time. Once it is efficient enough to reach the mass market, it will benefit from a larger user base and economies of scale, becoming more productive, which means that it will become more powerful and yet simpler for the users. A simpler technology, from a user perspective, means that less or no skilled professionals are required to manage it. This simplification enables new levels of complexity, making the technology easier to combine with other technologies and driving a positive feedback loop that fosters the appearance of more –-and novel- use cases for these particular technologies, enabling again new levels of complexity, and so on.

The extended use cases and the better price/performance of the technology will enable greater simplification of use in more scenarios, replacing more layers of the value chain over time in multiple products and services. In the end, this will completely change the landscape, rendering some businesses and jobs useless, and creating new jobs that did not exist previously.

The most important thing here is to pay attention to “weak signals”. Most disruptive technologies first appear as proof of concepts, mostly useless, lacking key features or performance; after all, most disruptive technologies started out in a laboratory or in companies’ dungeons.

If we look again to Kodak, they invented the digital camera back in 1975, although the concept was patented three years earlier by Texas Instruments employee Willis Adcock 22. How can the inventor of the digital camera be late in the race to win the digital camera market segment? They simply were not paying attention to weak signals. Moreover, they thought they could live forever from the photography film and paper, and that nothing was going to change that.

Figure 6. Kodak’s first digital camera. Source: http://nextshark.com/steven-sasson-kodak-digital-camera/

Of course, they were wrong, but how did they come to invent the digital camera? Their first digital camera (see the picture above), invented by the engineer Steven Sasson, took 50 milliseconds to capture the image, 23 seconds to record it to a tape, and then about 30 seconds to render a 100x100 pixels (0.01 Megapixel), black and white image on a TV screen. Not to mention its size and weight: it was made up of odd parts including a used lens from a Super-8 movie camera, a portable cassette recorder, 16 cadmium batteries, an ADC , and a few dozen circuits held together on six circuit boards. However, its performance was very poor: more than 20 seconds to record a 0.01 Megapixels black-and-white image.

What happened is that photography was digitised at this very moment (although the process started six years before with the invention of the CCD in the Bell Labs), but it was in the “deceptive” stage of the evolution. Who would ever pay for such low quality and slow device when they could buy a reflex film camera and make astonishing photos on high-quality paper?

Figure 7. Kodak’s first digital camera reproducing a photo. Source: http://petapixel.com/2010/08/05/the-worlds-first-digital-camera-by-kodak-and-steve-sasson/

The Disruption

That is what happens with many breakthroughs in technology. You digitise a process, creating a proof of concept, but the quality, or the performance, or price (or everything at once) is so deceptive that it is ignored. Over time, it keeps improving following an exponential curve like we have seen before. Continuing with the example of digital photography, moving from 0.01 to 0.02 megapixels is not an (apparently) substantial change. 0.01, 0.02, 0.04, 0.08… All looks like zero. However, when you are in the 0.64 megapixels, doubling performance will mean 1.28, 2.56, 5.12… so here the change is impressive. You just surpassed the deception point, moving from a deceptive technology to a disruptive technology.

If you do not watch out for weak signals, you are risking to ignore these technology breakthroughs. Trying to catch up with an exponential technology hitting the market may be extremely expensive and very difficult to achieve. That, in part, is what happened to Kodak –-they woke up too late.

The music industry also serves as a good example. They not only ignored weak signals and the Digital Transformation that was underway, but they also sparked it first and tried to fight against it later. As Josep Maria Ganyet points out in a wonderful short article 23:

“the appearance of the CD in 1982 was to the industry the goose that laid the golden eggs and the executioner, both at the same time. On one hand it allowed recording companies to sell us again the same music, arguing a better quality; but on the other hand, they were selling us the digital master rather than a copy”.

After selling the digital master, the recording industry (primarily Sony) first tried to convince all the CD-recorder manufacturers to introduce random errors when writing a CD. That way, instead of duplicating the digital master it would produce a copy that kept degrading on each new generation, in a similar way to what happened with analogue copies. However, it did not work because CD recorders had to copy software CDs as well, hence the copy needed to be identical to avoid corruption of the software. After failing in this attempt, they then tried to embed copy prevention mechanisms in the audio CD disks themselves, by inserting errors in the CD that would not affect audio but would cause CD recorders to fail when trying to copy those audio disks24 25. With further attempts, more or less without any success, ultimately has proven to be futile to impose copy protections, like putting doors in an open field.

What the industry failed to see –-or maybe they saw but did not know how to adapt to it- was how the business was changing. With the rise of digital music services like iTunes, people could now buy individual songs. Consumers only needed to pay for the songs they wanted and not any ‘filler’ songs. While if they did buy the whole album, they would end up paying the same or even a bit more, the unit of sale had been fragmented, causing at least two direct effects:

- It opened the doors to instant marketing information: e.g. Apple knew exactly which songs of an album were liked or disliked the most by the fans;

- Fragmenting the unit of sale to the level of individual songs changed how a musical work is conceived (do you remember the 45rpm vinyl singles?);

Dematerialising the product, demonetising the industry

So, they were digitising the product (firing up the Digital Transformation of the industry), with a key consequence: the music can be copied again and again without any quality loss (a digital duplicate is indistinguishable from the original). They effectively dematerialised the product. The music was just made of ones and zeroes.

Then came the MP3 format, in 1993, dematerialising music players. Then came Napster (1999), the first step to dematerialise record stores and to demonetise the industry. Then came the illegal music downloads. Now we have iTunes, Spotify, Pandora, Deezer, Google Music… Instead of embracing the digital transformation that they had started by selling the digital master, the music industry tried to fight against it. By the time they tried to embrace it, their strategy was wrong and it was too late to fail and try again. In his book “The Song Machine”26, John Seabrook writes:

“The MP3 was the next format. By 2002, that much was clear to the label groups. Therefore, the record business needed a digital marketplace where MP3s could be purchased legally. But the groups couldn’t agree on whose marketplace was better.

Sony and Universal joined together to create a subscription service called Pressplay. AOL, BMG, and EMI teamed with RealNetworks to create MusicNet, a download service. Neither service would license to the other one, which crippled them both. With the sense of urgency mounting, Steve Jobs, Apple’s founder, stepped into the breach with a cool proposal – The iTunes music Store. Roger Ames, head of Warner Music Group, saw Jobs’ presentation as the future.”

We don’t have the “Sony Music iTunes” or the “EMI Music Spotify” today. They don’t have a meaningful platform or offer for self-publishing, like Soundcloud. Similar changes happened to the books industry, with Amazon dematerialising bookstores .

So, when something becomes digital, it is effectively dematerialised. And when something is dematerialised, its marginal cost is near zero and the old hardware sales sink (just as happened with film when photos became digital). Therefore, we are at the doors of removing money from the equation. That is what is called demonetisation. Demonetisation is key to exponential technologies; it is the key to enable broad user adoption, as we will see later, but at the same time demonetisation is a key element of change. When a product or service has a cost near zero, it is time to find another way to deliver enough value to the users so they are -–still- willing to pay.

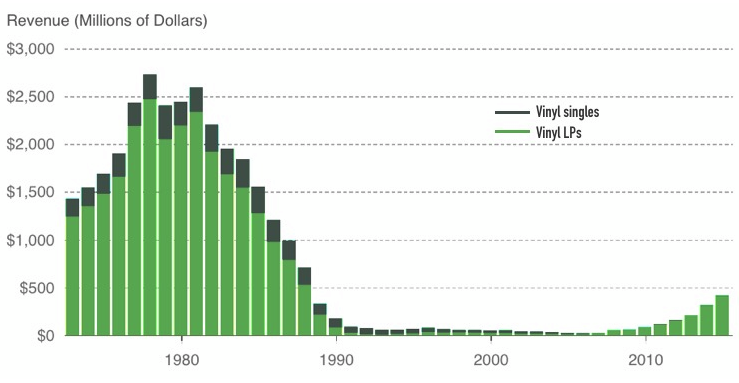

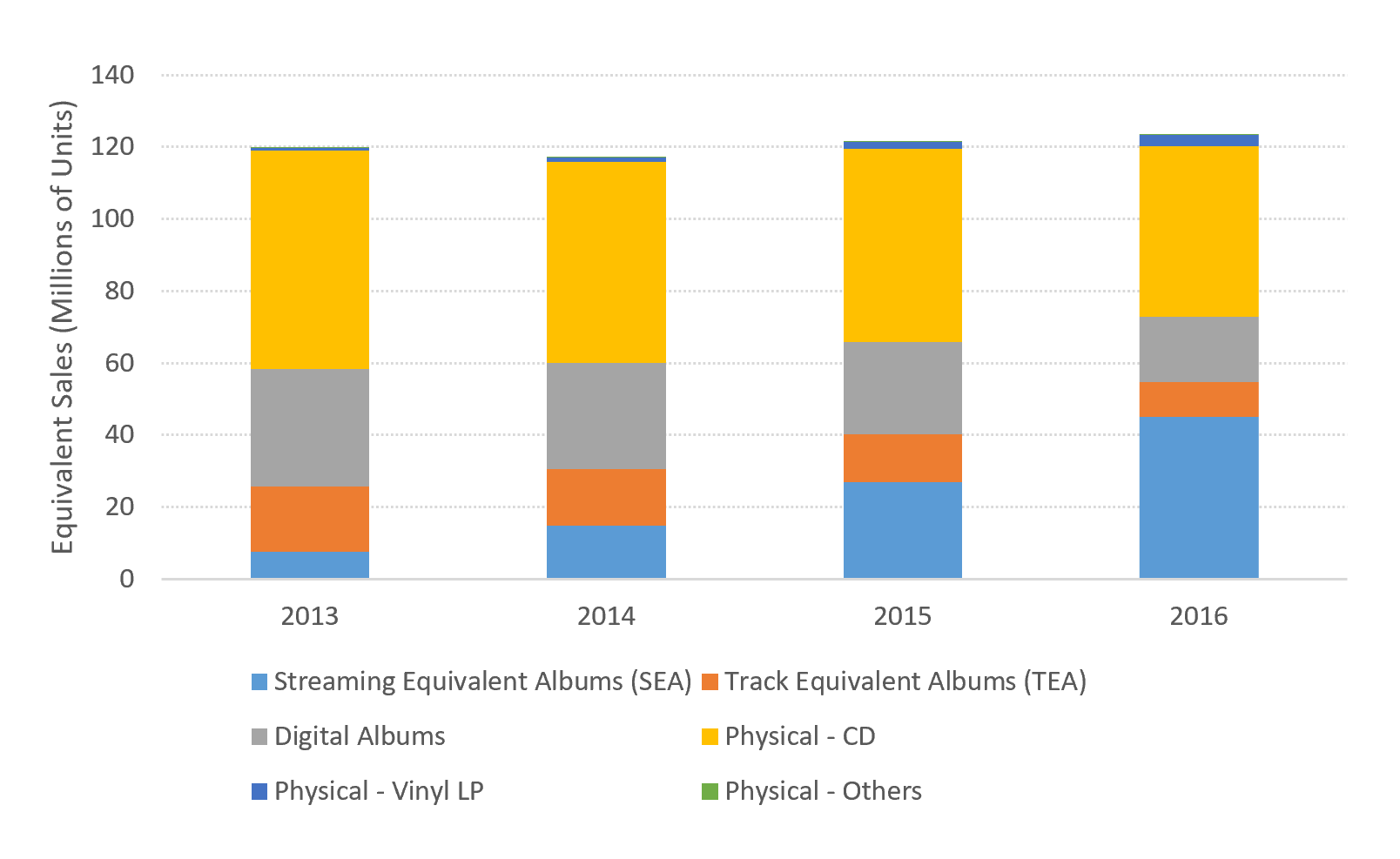

Going back to the music industry, as Ganyet points out in his article, vinyl album sales in UK out-performed digital downloads for first time during the 48th and 49th weeks of 2016. But more important than this, retailers not known primarily as music retailers are appearing, like supermarket chains Tesco and Sainsbury’s or Urban Outfitters, an apparel store. Although the sales levels on vinyl records remain a tiny fraction of sales in the 70s and 80s, as we can see in the chart below, it seems like a trend and data suggests that there is a lot of potential upside.

Figure 8. Sources: BPI Official UK Recorded Music Market Report for 2016 (https://www.bpi.co.uk/home/bpi-official-uk-recorded-music-market-report-for-2016.aspx); What the Vinyl Records “Comeback” Really Looks Like (http://www.digitalmusicnews.com/2015/01/20/vinyl-comeback-really-looks-like/)

So, what does all it means? Who could predict 10 years ago that vinyl records will surpass digital music sales? Possibly, time will tell, we are starting to see a change in music consumption / shopping habits.

Ganyet makes some very insightful questions in his article: when was the last time you just listened to the music, without doing anything else? What about the Paradox of Choice27 (the anxiety caused by the risk of making a mistake when choosing a single element over infinite options)? What is clear is that there is some additional value in the vinyl that was not obvious previously – more sales, new distribution channels that we could not have imagined some years ago, and a higher price but still more sales, reinforce that. Maybe it is the pleasure to just listen to the music without doing anything else, something that –for some reason- seems more frequent with vinyl than with other mechanisms; maybe it is the content of the album, with photos, booklets, lyrics…; maybe it is just having something physical that has some obvious intrinsic value attached; or maybe it is some “retro” vibe, a desire for more authentic sounds opposed to the purity of digital. Whatever it is, there is still room to grow after Digital Transformation by taking advantage of new, or latent, or hidden elements of value for the user; it is just a matter of transforming the nature of the business to adapt. So the industry should change too if they want to survive.

Figure 9. Comparisson of equivalent music sales. Source: BPI Official UK Recorded Music Market Report for 2016. For detailed information and data see https://www.bpi.co.uk/home/bpi-official-uk-recorded-music-market-report-for-2016.aspx.

As I said, data suggests that there is a lot of potential upside, so finding where and to what the user is attaching this extra value is key for the industry to be able to grow again. As you can see in the chart above, CD audio sales are declining, but sales of digital albums (not streaming services) are declining even more; the winners are streaming services and the vinyl LP sales, that are growing at an astonishing rate 28.

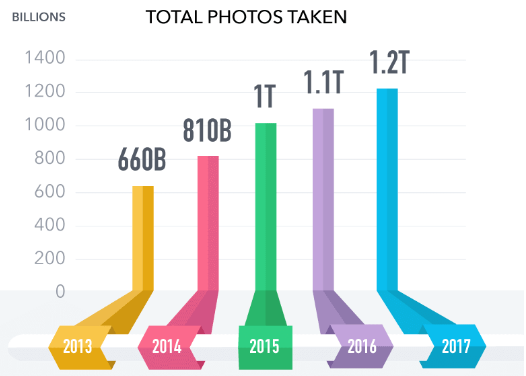

A similar change happened with photography. Nowadays we make more photographs than ever before 29, thanks to the dematerialisation of the photo and the posterior democratisation of the digital camera.

The expected number of photos to be taken worldwide in 2017 is 1.2 trillion. Assuming you stored a picture every second, it would take about 148,872 years to reach that number. Or, in another way, if you print all those photos in high quality photo paper and stack all the photos on the floor (at sea level), it can fly you to the moon .

Kodak went into bankruptcy after their film and paper sales plummeted. Digital cameras are declining in use, as people are increasingly using mobile phones to take photos. However, other areas of business are growing and new opportunities are arising:

-

The total number of photos stored is expected to grow from 3.2 trillion in 2015 to 4.7 trillion in 2017. So, there is a storage challenge there. Just at 2.5 Megabytes average photo size (a JPG from an iPhone 6 ), 3.2 trillion photos accounts for over 10 Exabytes. With all our memories being digital, having the proper storage and backup of our precious moments is crucial, but this can still be a challenge today for most non-technical people. So here, there is room for new businesses that help to create a proper data protection strategy in an easy and affordable manner.

-

Cataloguing such huge amounts of information is another challenge. Your mobile phone may help you, as Google or Facebook may do too, but you probably do not have all the family photos in one single location. You changed your mobile phone several times, your partner or your children store photos in a different place, your mobile contains both personal photos and work photos (such as the capture of that whiteboard or slide)… New technologies like machine learning, deep learning, and applications of those like face and object recognition clearly will help to spread the use of photo cataloguing software making it easier to use and more automated —there are opportunities there too.

-

People using DSLR cameras (or some last generation mobile phone) can choose to take photos in what is called RAW format. This format needs to be “developed”, or converted, in a similar way it was needed for film photos, but using software instead of chemical baths. Developing photos, once reserved to professional photographers and specialised shops, is something that many amateurs are doing by themselves now. But what if you want to shoot in RAW to benefit from the higher quality, but still want a professional photographer to develop your photos? That is a new business opportunity.

Digital Transformation does not mean the end of the business, nevertheless. However, if the product or service is being digitised, it is being dematerialised. Since the perceived value of a dematerialised product (by itself) is near zero, it means that the value for the user must be put somewhere else, causing a disruption of the industry being digitised. However, as we have seen, this will create new opportunities: new revenue streams, new potential customer base (sometimes growing, sometimes shrinking the total addressable market), new players entering into the game, and incumbent players dying due to their failure to adapt.

From Disruption to Democratisation

Once the product or service has been demonetised and due to the exponential growth of technologies (as per Moore’s law), it becomes cheaper and so more affordable, triggering the number of users to explode. We have seen several examples through this whitepaper.

Cell phones or digital cameras were luxury items a couple of decades ago. GPS were very expensive three decades ago, too. However, now 50% of the world is carrying a GPS receiver, a digital camera and a computer substantially more powerful than the one used to take the man to the moon, all in one, in their pocket. Over time, access becomes democratised, available to most people, or to almost anyone eventually.

Another interesting example is Blockbuster and Netflix. In early 2000s, Blockbuster had the option to buy Netflix –then a DVD-by-mail rental company- for $50 million. However, Blockbuster preferred to invest in a joint-venture with Enron because Netflix –-a just 3 year old company then- was losing money (30,31). At the time of writing, Netflix has a market cap of $57.29 billion 30. Blockbuster filed for bankruptcy protection in 2010, after losing significant revenue 31. In March 2011, Netflix invested around $100 million to buy the rights for House of Cards, beginning a trend of acquiring original content for its library, in a smart strategic move to avoid commoditisation by having something exclusive, something scarce32 33.

Netflix and Blockbuster were essentially in the same business, DVD rental (although Blockbuster also rented videogames); Blockbuster was doing it through a franchise network of physical stores, while Netflix was doing it by mail. This is a great example of the difference between management and strategy; what a lack of vision and long-term thinking can lead to. Netflix, however, had managers with vision who played strategically.

Moving from DVD rental to an online streaming service proved very successful for Netflix. It allowed them to grow faster and be able to adapt their business to user needs faster, with rapid delivery of those changes to users (thanks to what has become known as “continuous delivery” in the software industry) with immediate and continuous feedback. They can track all the actions of their users –content searches, views, language and subtitles use…-, providing an important advantage over their competitors if they can analyse all this data and get knowledge from it. It allows them to provide more value to their users, creating a positive feedback loop. Also, while providing their own application (online, mobile, and embedded on TVs), Netflix is setting a higher barrier to entry for competitors and increasing their brand awareness to users.

With more users, there is more information to make use of, more information we can extract, unlocking even more business opportunities… but nothing looks like it did before anymore. So you need to watch for those weak signals. You better be prepared for the change, or the change will kill you.

The Day After

Final thoughts

What will happen then, after you have jumped into the Digital Transformation of your business? The answer is clear: when you start the journey to the Digital Transformation of your business, you are starting to dig the grave of your own business. It will never be the same again.

That is exactly what happened with the digital photography and the chemical photo business, or with the CD and the music industry. Maybe it could have been EMI, Sony Music, Warner, Universal, or maybe all of them in a joint venture, who were running the iTunes or Spotify of today. However, it has not been the case. The music distribution business today is led by technology companies, despite innovations such as the ATRAC family of audio compression algorithms, similar to MP3 (and used in MiniDisc), being invented by Sony before the creation of MP3.

Does it mean you should avoid Digital Transformation? Absolutely not! You must embrace Digital Transformation. Instead, you should start planning for the day after. So, ask yourself:

- What is the current landscape and how it may evolve?

- How does our value chain look like and how may it change? And what about our revenue streams?

- How will my business look like after being digitised and after overcoming the deceptive phase of the technology?

- What new opportunities will arise in the plateau of productivity stage, when the technology is mature?

- How do we travel from our current position to the new place where we want to be in that mature stage?

- How do we position ourselves?

- Think about the message, about the value proposition to your clients: What do my users care about? Ask them!

- What do we need to go through this journey?

And, most important, expect to dramatically increase the pace into a journey of change that will never end.

Next steps

I hope that this paper has provided you with some insights about the long-term implications of Digital Transformation. I have tried to make you think holistically, beyond the simple digitalisation of some business processes. As you have seen, implications and effects are deep and wide; hence, starting such a journey requires calm and consideration with a strategic point of view.

If you are willing to start the Digital Transformation of your business, what are the action points? Where should you start? What are the next steps? This is not too different from any other process of change. The only significant specifics to take into account are:

- Higher speed of change. The pace of change is dramatically increasing for all business and in every sector. Digital Transformation is increasing this pace even more. Higher speed means less time to react, so proper strategy planning and continuous situational awareness are key, not only for success, but for avoiding some pitfalls that you may not recover from.

- The impact of any important transformation is never obvious, but in the case of Digital Transformation there is a higher degree of uncertainty and less evidence about the potential outcomes and side effects, especially when acting on a company with a global and large footprint. Perhaps it is, among other reasons, because information technologies are less widely known and understood by executive management than other areas (e.g. finance), but its potential impacts on a business are huge.

So, trying to put up a list of what to do and what to care about, I have come up with the following “Ten Commandments of Digital Transformation”:

1. Strategy is key.

As Seneca said, “If one does not know to which port one is sailing, no wind is favorable”. Without a long-term strategy, forget about a successful transformation. Strategies may fail, but without it any successful transformation will be sheer luck. So, before starting the journey of Digital Transformation, think carefully about strategy. A long term strategy with a focus on agility, adaptability and speed to transfer changes to market.

There is no good strategy without a proper situational awareness in first place, and the means to analyse it in a structured way. If you do not know where to start, I recommend reading Simon Wardley’s articles on strategy and value chain mapping in his blog: https://blog.gardeviance.org.

2. Be alert of weak signals.

Once you have mapped your organisation and evaluated the different “where”, “what” and “why”’s, it is time to put the strategy into action. You will need some sort of “Signal Intelligence”, as referred in the military jargon, to continuously re-evaluate your position (your situation) with proper awareness of the movements in the market. Listening to customers, being critic about yourself and properly assessing customers complaints, even veiled complaints, is key to detect subtle but important changes. Book specific time periodically with a small team (less than 5 people in total), out of the office whenever possible, to reassess the situational awareness analysis, the weak signals and the overall strategy. Ideally include in this team an external advisor.

3. Think big and long-term, start small and short-term.

If you are running an already established company, it requires courage and some share of bravery to change the business knowing you may lose (part of) your revenue streams and customers. However, not to change is not an option, it is a must and it will happen anyway. In this situation, if you want to engage all the stakeholders, you will probably look for quick-wins that you can capitalise on to reduce risk, convincing those that may be more reluctant to big changes. If this is the case, start optimising processes and tools by making it digital, so you can reduce waste and be more lean and agile. At the very least, you will be more profitable or competitive through increased efficiency, and in the best case you will have set up the basis for an agile and adaptable organisation. But do not forget what we have seen in the chapter The Business Digitalisation.

4. Embracing Digital Transformation ignites the death of your (current) business.

We have seen this idea along this document through some real examples. Challenge yourself about everything. Be curious and self-critical. Do not be shy about change. Be ruthless to jettison incumbent ideas and practices. As the saying goes – you cannot make an omelette without breaking eggs.

5. Cannibalise yourself.

If you know a better way to do something, if you know how to improve your product or service or how to lower your costs, if you know that your users may be looking for something different that may replace your offering, JUST DO IT. Otherwise, others will do. The best way to be ahead of competition is to be your fiercest competitor.

6. Adaptability and Speed.

As previously said: Speed is the new currency. Adaptability is the new key core skill. Being disruptive is the higher order challenge.

7. Learn technology.

All businesses in all sectors will be (if not yet) heavily transformed by Information Technologies, like it or not. Who decimated the music business, recording studios or technology companies? And media / broadcast production? (Hint: Netflix). And who is disrupting finance and banking industry? (Hint: a whole new sector, FinTech). And who disrupted travel, tourism and transportation? (Hint: Uber, Airbnb, trip4real…). You should understand the language of technology to be able to talk with the new generation of hackers. Luckily, you do not have to learn the nitty-gritty details; just have enough technological culture to be able to understand the impact of technologies and to talk with your CTO / CIO as you do with your CFO. Having some very basic concepts, at a very high level, on subjects like Cloud computing, Big Data, Machine Learning, and Blockchain is fundamental to any manager for the next decade. Sites like Coursera and EdX are awesome places to find some training tailored to your needs. A trusted technology partner willing to share knowledge is a fantastic option, too.

8. Partner with others that complement your value chain.

Finding partners that provide you expert coverage on areas of the value chain that are not your core expertise –instead of vertical integration on each value proposition- can add significant value for your customers, help you run operations in a more efficient way, and ultimately enable you to be more agile and adaptable. Technology is not an exception. Technology can be complex; it is complex. Having a good vision and the perfect strategy to develop it around your core business is not enough. Many companies fail too often because they are not an IT-expert company, but a publishing, or finance or industrial company struggling to build an IT architecture, development and operations company inside them, and they lack the expertise and experience to do so.

9. Have a traveling companion.

Having a trusted advisor who is external to the company, not depending on your company to make a living and not tied to its internal politics is always highly valuable. Look for somebody who is expert with technology and with experience in walking this kind of journey together with others in similar situations. Avoid fortune-tellers who predict the future, tricksters just selling whatever you ask for without questioning anything, and those who worry more about the latest technology trend than about the value of technology to your business. Look for somebody with the willingness, capabilities and experience to train and transfer knowledge to you and to your teams.

10. Care for the cultural change through continuous learning, unlearning and feedback.

Changing the roots of the business implies changing company’s culture. Embracing change as a constant, opposed to an isolated change, is an enormous cultural change for most companies. Changing culture is very difficult, especially for large organizations. A good way to do that is to start by changing habits (the way we do what we do), introducing new tools that enables new ways to work, but, above everything, that fosters communication. And by changing habits and tools, you will change what people do, you will change how people do what they do, and the way they communicate (the narrative). At the end of the day, you will have changed the culture. But embarking on Digital Transformation means also significant learning, and changing at a fast pace means learning all the time. Alvin Toffler said: “the illiterate of the 21st century will not be those who cannot read and write, but those who cannot learn, unlearn, and relearn”. So be prepared to learn, unlearn and relearn; this process requires a lot of feedback in all directions and a huge investment in training. If you do invest though, then it will be less difficult to change the culture again when needed (it will be never easy though). Probably you do not need the level of obsessive investment in training that some leading tech companies make (except if you are working on cutting-edge technologies), but do not even try to be shy or miserly when it comes to training, or it will come back to bite you. As Eppie Lederer said, “if you think education is expensive –try ignorance” 34. Perhaps better not to try.

The take away

Do not think about what Digital Transformation can do for you; instead, think about what you can do with it. There will be multiple opportunities waiting for you, but you have to think about those future scenarios, select the ones where you want to compete and make a plan, if you want to leverage them.

If you want a short action list to keep in mind, something akin to a guiding North Star, Richard Foster provides a very nice 3-point action list 35:

The life span of a corporation is determined by balancing three management imperatives:

- Running operations effectively.

- Creating new businesses which meet customer needs.

- Shedding businesses that once have been core but now no longer meet company standards for growth and return.

Of course, knowing which new business to create and which old business to shed, knowing from where and to where you are going, requires strategy. With that in mind, I came up with the 3 key elements of strategy, borrowing from the military – these are nothing else that an implementation of the OODA loop (Observe → Orient → Decide → Act) from the US military 36:

-

Situational awareness. Know how the pieces are set on the table, study and understand the strengths and weaknesses the landscape provides you. Make a map. Understand your value chain and think about how it may evolve.

-

Signal intelligence. Observe and analyse what is happening around you, to properly update your situational awareness.

-

Scenario planning. To choose the right port to sail to, and so the next move, you need to assess several options. Having more than one potential destination is always a good idea, just in case things become different from expected.

Well, there is a 4th: “NO”. Saying NO is the most powerful word in business strategy to keep you focused on your way. It is very easy to get fooled into every potential opportunity you face every day, but it is hard to choose wisely and say yes only to the ones that guide you more to your destination. So every time you face a new opportunity, ask yourself: is it putting me farther or nearer my next station?

A final word

Do you want to become an exhibit in the museum of corporate dinosaurs?

-

Diamandis P, Kotler S. Bold: How to Go Big, Create Wealth and Impact the World: Simon and Schuster; 2015. ↩︎

-

Tesla Motors, Inc. Tesla.com. [Online]. Available from: https://www.tesla.com/. ↩︎

-

O’Hara M. Market Realist: An Investor’s Guide to Tesla Motors. [Online].; 2015. Available from: http://marketrealist.com/2015/08/investors-guide-tesla-motors/. ↩︎

-

Sparks D. The Motley Fool: Tesla Motors, Inc.’s greatest advantage: software? [Online]. Available from: http://www.fool.com/investing/general/2015/12/08/tesla-motors-incs-greatest-advantage-software.aspx. ↩︎

-

EV Obsession. EVObsession: “Tesla’s competitive advantages - 5 Big Ones”. [Online]. Available from: http://evobsession.com/tesla-competitive-advantage-5-big-ones/. ↩︎

-

Wikipedia. Wikipedia: Tesla US dealership disputes. [Online]. Available from: https://en.wikipedia.org/wiki/Tesla_US_dealership_disputes. ↩︎

-

Mudallal Z. Qz: Airbnb will soon be booking more rooms than the world’s largest hotel chains. [Online].; 2015. Available from: http://qz.com/329735/airbnb-will-soon-be-booking-more-rooms-than-the-worlds-largest-hotel-chains/. ↩︎

-

Wikipedia. Wikipedia: Blockchain (database). [Online]. Available from: https://en.wikipedia.org/wiki/Blockchain_(database). ↩︎

-

Rosic A. VB: Blockchain and humanitarian causes helping those who need it most. [Online].; 2016. Available from: http://venturebeat.com/2016/12/11/blockchain-and-humanitarian-causes-helping-those-who-need-it-most/. ↩︎

-

Rose DS. Associate Founder, Singularity University. ↩︎

-

Wikipedia. Wikipedia: Moore’s Law. [Online]. Available from: https://en.wikipedia.org/wiki/Moore%27s_law. ↩︎

-

Moore GE. Cramming more components onto integrated circuits. Electronics. 1965 Apr 19; 38(8): p. 4. ↩︎

-

Roser M. Our world in data: Technological progress. [Online].; 2016 [The source is Koomey, Berard, Sanchezm and Wong (2011) - Implications of Historical Trends in the Electrical Efficiency of Computing. In IEEE Annals of the History of Computing, 33, 3, 46-54.Data based on Nordhaus 2007 with additional data added post-1985]. Available from: https://ourworldindata.org/technological-progress/. ↩︎ ↩︎

-

Pachal P. Mashable: Amazon’s Cloud: a supercomputer anyone can rent. [Online].; 2011. Available from: http://mashable.com/2011/12/30/amazon-cloud-supercomputer/. ↩︎

-

Kurzweil R. Kurzweil: The Law of Accelerating Returns. [Online].; 2001. Available from: http://www.kurzweilai.net/the-law-of-accelerating-returns. ↩︎ ↩︎

-

TOP500.org. TOP500 Supercomputer Sites: November 2016. [Online]. [cited 2017 01 16. Available from: https://www.top500.org/lists/2016/11/. ↩︎

-

Huy Q, Vuori T. INSEAD Knowledge: What could have saved Nokia, and what can other companies learn? [Online].; 2014. Available from: http://knowledge.insead.edu/strategy/what-could-have-saved-nokia-and-what-can-other-companies-learn-3220. ↩︎

-

Wikipedia. WIkipedia: Coopetition. [Online]. Available from: https://en.wikipedia.org/wiki/Coopetition. ↩︎

-

Innosight. Creative Destruction Whips Through Corporate America. Innosight; 2012. ↩︎

-

Kotler S, Diamandis P. Abundance: The Future Is Better Than You Think: Simon and Schuster; 2012. ↩︎

-

Gartner, Inc. Hype Cycle Research Methodology | Gartner, Inc. [Online]. Available from: http://www.gartner.com/technology/research/methodologies/hype-cycle.jsp. ↩︎

-

Wikipedia. Wikipedia: Digital camera. [Online]. Available from: https://en.wikipedia.org/wiki/Digital_camera. ↩︎

-

Ganyet JM. Via Empresa: el vinil guanya les descàrregues. ‘Hipstèria’ o usabilitat? [Online].; 2016. Available from: http://www.viaempresa.cat/ca/notices/2016/12/el-vinil-guanya-les-descarregues.-hipsteria-o-usabilitat-22907.php. ↩︎

-

Wikipedia. Wikipedia: Compact Disc Digital Audio. [Online]. Available from: https://en.wikipedia.org/wiki/Compact_Disc_Digital_Audio#Copyright_issues. ↩︎

-

Wikipedia. Wikipedia: Sony BMG copy protection rootkit scandal. [Online]. Available from: https://en.wikipedia.org/wiki/Sony_BMG_copy_protection_rootkit_scandal. ↩︎

-

Seabrook J. The Song Machine: Inside the Hit Factory: W. W. Norton & Company; 2016. ↩︎

-

Wikipedia. Wikipedia: Paradox of Choice. [Online]. Available from: https://en.wikipedia.org/wiki/The_Paradox_of_Choice. ↩︎

-

British Phonographic Industry (BPI). BPI official UK recorded music market report for 2016. [Online].; 2016. Available from: https://www.bpi.co.uk/home/bpi-official-uk-recorded-music-market-report-for-2016.aspx. ↩︎

-

Perret E. Mylio: Here’s how many photos will be taken in 2017. [Online].; 2016. Available from: http://mylio.com/true-stories/next/how-many-digital-photos-will-be-taken-2017-repost. ↩︎

-

Google. Google Finance: Netflix, Inc. [Online]. Available from: https://www.google.com/finance?q=netflix. ↩︎

-

Wikipedia. Wikipedia: Blockbuster LLC. [Online]. Available from: https://en.wikipedia.org/wiki/Blockbuster_LLC. ↩︎

-

Andreeva N. Deadline | Hollywood: Netflix To Enter Original Programming With Mega Deal For David Fincher-Kevin Spacey Series ‘House Of Cards’. [Online].; 2011. Available from: http://deadline.com/2011/03/netflix-to-enter-original-programming-with-mega-deal-for-david-fincher-kevin-spacey-drama-series-house-of-cards-114184/. ↩︎

-

Wikipedia. Wikipedia: Netflix. [Online]. Available from: https://en.wikipedia.org/wiki/Netflix. ↩︎

-

Pennington J. Quora. [Online].; 2014. Available from: https://www.quora.com/Who-said-If-you-think-education-is-expensive-try-ignorance. ↩︎

-

Foster R. Creative Destruction: why companies that are built to last underperform the market and how to successfully transform them: Crown Publishing Group; 2001. ↩︎

-

Wikipedia. Wikipedia: OODA loop. [Online]. Available from: https://en.wikipedia.org/wiki/OODA_loop. ↩︎